January 2022

Whitney Oachs, Research Associate

For a printable version of this report, click here.

In 2007, Minnesota set a goal of reducing the state’s carbon emissions by 80% by 2050. Since then, electric utilities have been making significant progress, but not enough to meet the state’s interim carbon-reduction goals.

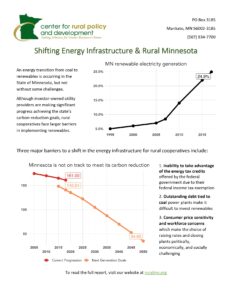

The MN Department of Commerce’s Renewable Energy Update shows that 24.9% of electricity generated in Minnesota came from renewable sources in 2018, compared to 8.4% in 2007, an increase of over 300% in just ten years. Wind power alone generated 18.2% of Minnesota’s electricity in 2017, and large increases in wind power are expected over the next three years from projects that are already approved and in development.

Meanwhile, electricity from coal dropped to 39% of total electricity generated in 2017, down from 59% in 2007. At that same time, renewables surpassed nuclear energy for the first time as the second largest source of electricity generated in MN.

Source: U.S. Energy Information Administration (EIA)

And yet, despite this progress, a 2021 biennial report from the Minnesota Pollution Control Agency (PCA) stated that greenhouse gas emissions declined by only 8% in the state between 2005 and 2018 and that Minnesota is not on track to meet its goal of a 30% carbon reduction by 2025.

Data: Minnesota Pollution Control Agency

Minnesota’s transition to renewable energy

When the Minnesota Legislature passed the Next Generation Act in 2007 under Governor Tim Pawlenty, they established a set of goals intended to move the state toward getting our electricity from sustainable and/or renewable sources.

Implementing a transition to renewables is more complicated than flicking a switch, though: it’s expensive. Technologically and logistically, converting the entire U.S. power grid to 100% renewable energy in the next decade is attainable, but it would cost an estimated $4.5 trillion, according to a recent analysis by the energy research firm Wood Mackenzie. The estimate represents the cost of replacing all fossil fuels and nuclear power with hydroelectricity, biomass, geothermal, wind, and solar. The price tag would drop to $4 trillion if nuclear were allowed to remain part of the energy mix, Greentech Media reports.

To help utilities along, the federal and state governments are offering incentives primarily through tax-breaks. These tax credits serve as an indirect federal subsidy to finance the investment and production of renewable energy by offering tax forgiveness to companies investing in renewables. These incentives have helped investor-owned utility firms like Xcel Energy and Minnesota Power lead the charge towards carbon-reduction.

Xcel Energy is Minnesota’s largest electric utility, serving 3.7 million customers in eight states. In April 2021 they announced a reduction in carbon output by 80% and would end its use of coal to generate power by 2030.

Data: Xcel Energy

Minnesota Power, the major electricity provider in northeastern Minnesota, also transitioned its energy sources from 95% coal to 50% renewables between 2007 and 2020. With plans to retire its Cohasset coal plant, Minnesota Power intends to become carbon-free by 2050.

It’s a different set of rules for cooperatives

Electric cooperatives have not made the same strides in shifting towards renewables. According to the National Rural Electric Cooperative Association (NRECA), rural co-ops continue to derive 66% of their annual energy from fossil fuels, and operate under a different set of rules than investor-owned providers.

Nationally, rural electric cooperatives power 56% of the nation’s land mass and are the economic and infrastructural cornerstones for the rural communities they serve. In Minnesota, cooperatives employ about 2,974 people and operate over 135,000 miles of transmission lines, covering around 34% of Minnesota residents.

Data: National Rural Electric Cooperative Association (NRECA)

Electric co-ops were created to bring electrical service to those low-density areas that were and still are not cost-effective to serve. To make service feasible, co-ops are tax-exempt organizations under the Internal Revenue Code (IRC), so long as they receive at least 85% of income from members. Cooperatives are given these regulatory allowances to help them stay in business while providing electricity to a higher-cost group of customers.

Before 1930, only about 3% of farmsteads across the country had access to electricity. During the New Deal, President Franklin Roosevelt created the Rural Electrification Administration in 1936—known today as the Rural Utility Service—under the Public Works Administration, to electrify these regions.

Data: National Rural Electric Cooperative Association (NRECA)

Out of this drive to bring electricity to rural areas, Minnesota developed a patchwork model of investor-owned companies, local government-owned utilities, and member-owned co-ops providing services across the state. Electric cooperatives serve most rural Minnesota households, while investor-owned firms like Minnesota Power and Xcel Energy serve Greater Minnesota’s regional population centers.

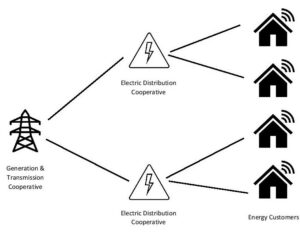

Local electric distribution co-ops are member-owned: their members are both customers and owners. But these local co-ops don’t generate the electricity. These distribution co-ops are members of larger generation & transmission (G&T) cooperatives, which produce and transmit “energy pools” to their members (Figure 4).

Minnesota is home to 44 distribution cooperatives, which are in turn served by six G&Ts. This means that while there are many different distribution co-ops serving their specific communities, the power they distribute comes from the power pools of just a few large G&Ts. Cooperatives average around 6.6 customers per mile of distribution line, while all other utilities (including investor-owned and municipal services) average 32 customers per mile of line. The median membership size of a distribution cooperative is 8,296 members, but ranges from a thousand to more than 132,000.

What’s keeping electrical co-ops from moving forward on renewables?

Co-ops are still expected to achieve the carbon-reduction standards established in the Next Generation Act, but because their co-op status already affords them special treatment, they don’t qualify for the incentives, and that’s a problem. While some G&T cooperatives like Great River Energy have committed to 50% renewable energy by 2030, other cooperatives disagree, citing the sunk costs they would incur by retiring coal plants. According to Syd Briggs, general manager at Steele-Waseca Cooperative Electric, “we’re all concerned about the climate—but a lot of co-ops are also concerned about the cost… funding is a must for the future of renewables.”

Three major barriers are holding rural cooperatives back from making the shift in their energy infrastructure:

-

Outstanding debt tied to coal power plants make it difficult to invest renewables.

To accelerate rural electrification, the REA began administering federal loans to member-owned electric cooperatives, who then invested in the construction of coal plants and utility lines to distribute electricity to their members. The method of financing was effective: by 1959, 90% of farmsteads were receiving electricity via electric cooperatives.

But today, across the country, many local distribution cooperatives are locked into 40-plus-year contracts with their G&Ts, some of which allow only a couple dozen kilowatt hours of local renewable energy generation. This is due to the major investments these G&Ts have made in coal and fossil-fuel plants, which have resulted in outstanding debt for the organizations and impact a cooperative’s ability to shift power sources affordably and quickly. This system of financing has remained largely unchanged since the mid-20th century and continues to influence our current infrastructure.

The result is that the debt structure that originally supported electric cooperative growth now ties them to aging coal-fired power plants, exacerbating expenses for both the customer and organizations. Until this issue is addressed by governing bodies, rural electric cooperatives are especially unlikely to “go green.”

-

Inability for cooperatives to take advantage of the energy tax credits offered by the federal government due to their federal income tax exemptions

Importantly, electric cooperatives are not eligible for green-energy tax credits because of their federal income tax exemptions, making the task of an energy transition much harder for rural utility providers. Without government support, it is up to the cooperatives and their members to shift toward renewables, all while balancing existing debt tied to coal and other fossil fuels.

Developing renewable energy affordably and accessibly has proven challenging for both electric distribution and G&T cooperatives. Unlike investor-owned utilities, co-ops can’t raise equity and instead rely on memberships and outstanding debt for financing needs.

-

Consumer price sensitivity and workforce concerns which make the choice of raising rates and closing plants politically, economically, and socially challenging

Outside of providing energy, existing coal power plants offer local jobs and tax revenue to the rural communities they are located in. As such, the prospect of closing coal plants is often accompanied by workforce and economic development concerns. Although power-plant workers are by no means unskilled, their training does not easily translate to renewables, and technology using renewables often employs fewer people than other forms of energy generation.

According to the American Council for an Energy-Efficient Economy, rural Minnesotans have a median household energy burden of 4% of household income, as compared to the national burden of 3.3%. In addition, rural low-income households spend about 9% of their income on energy bills, almost three times the urban average of 3.1%, according to the same report. This cost differential is driven primarily by the distance and cost of materials required for energy to travel to each individual customer, the lower incomes of rural households, and a smaller return on investment for co-ops compared to investor-owned providers.

And as the rising price of fossil fuels and high up-front cost of development has nearly doubled the average Minnesotan’s monthly electric bill in the past two decades, concerns about affordability are very real.

Source: U.S. Energy Information Administration (EIA)

Electric cooperatives are not the only utilities facing these challenges. According to Minnesota Power’s Jennifer Cady (a Center for Rural Policy & Development board member), government incentives have helped, but do not entirely make up for the cost of implementing new renewable infrastructure. In November 2021, Minnesota Power asked the Minnesota Public Utilities Commission for permission to increase electric rates 18%. These rate increases are often cause for concern among their customers. Not only are rural residential households more price-sensitive due to lower-than-average incomes, but the energy-intensive manufacturing and mining industries Minnesota Power serves are globally competitive and price-sensitive.

Minnesota Power provides electricity to a 26,000-square-mile service area in northeastern Minnesota, but only about 13% of utility’s customers are residential homes. Three quarters of the power they generate goes to mining, steel, and paper production plants. These industries compete on a global scale, and the price of electricity adds to the cost of production.

Rolling blackouts and grid-system concerns

Worries about the reliability of the electric grid following the rolling blackouts in Texas in 2021 are also amplifying tensions surrounding renewable systems, as energy storage and distribution operate differently under solar, wind, and hydroelectric infrastructure, as compared to coal and natural gas. Although the infrastructure and heating issues experienced in Texas may seem unrelated to power in Minnesota, the generation and transmission power pools used by Minnesota co-ops tend to have customers across state lines, making the relationship between nationwide outages and blackouts something to pay attention to.

To some co-op managers like Patrick Carruth of the Minnesota Valley Electric Cooperative, there is a direct link between the push for renewable energy and the possibility of rolling blackouts during frigid winter months.

Many coal and natural gas plants are reaching the end of their lifespan, and the transmission line infrastructure that supports it is aging as well, increasing the likelihood of blackouts and energy disruptions. According to Carruth, however, new energy investments tend to favor renewables, which leaves these aging systems to decline without further funding. And while a future of green energy is on the horizon, wind and solar energy are at present unable to accommodate all of our energy needs.

While the rolling blackouts that devastated areas of Texas during February 2021 were due in part to the malfunction of wind turbines, gas-powered heat was largely to blame. And both issues have been attributed to Texas infrastructure’s inability to cope with extreme cold temperatures. According to an analysis by the Texas Tribune, the largest source of energy in Texas is natural gas, and it was the freezing and failure of those systems which led to the widespread rolling blackouts. While wind turbines in the state did freeze, less than 10% of winter energy and heat capacity in those regions was powered by wind before the blackouts.

While temperature issues are also present in areas of Northern Minnesota, northern energy infrastructure tends to have better practices and policies to cope with the cold. Nevertheless, during Texas’ blackouts, the Western Area Power Administration, which covers several western Minnesota counties and is part of the same Southwest Power Pool that serves Texas, instituted blackouts that affected three North Dakota oil counties for two days, leaving some producers without electricity for their operations.

Despite this, Minnesota is not in imminent danger of rolling blackouts, according to Syd Briggs, from Steele-Waseca Cooperative Electric. “Controls occur a few times a year, where we have to cut off certain facilities to increase capacity,” Briggs said, “but we have a system in place so that what happened in Texas does not happen here.” For Briggs, the biggest issue facing electric distribution is the lack of adequate transmission lines. “We could easily go 90% renewables in the near future, but we need the infrastructure to support that.”

Moving Forward

While all utilities need assistance to transition to renewable energy generation, cooperatives face particularly strong barriers in doing so. Co-ops nationwide wield enormous political power when working together, but the politics of renewables and coal keep tensions high. Nevertheless, in February 2021, the Rural Power Coalition asked Congress to increase support for rural electric cooperatives to spur recovery from COVID-19 and ensure an equitable energy transition.

The letter to Congress writes: “The Rural Power Coalition (RPC) is calling on Congress to enact seven policies to support rural electric cooperatives in transitioning to a more sustainable electric grid. The crippling of Texas’ power grid by a cold snap is a tragic yet timely reminder of the importance of rural infrastructure, especially as the United States considers massive COVID-19 relief and climate change-related infrastructure investments.” Their recommendations include:

- Reform the Rural Utility Service Hardship Loan Program and direct $100 billion to rural electric cooperatives so they can forgive unpaid residential utility bills, continue service for the hardest-hit families, and deliver more affordable power to rural households. This investment would quickly mitigate the economic hardship many rural people are facing today and jump start infrastructure projects that will create hundreds of jobs in every state.

- Add $17 billion to the Low-Income Home Energy Assistance Program for residential electricity bill relief.

- Ensure equal treatment in reform of renewable energy tax credits under The Moving Forward Act.

- Include additional funding for rural development (ruralpower.us)

The impact on the rural workforce also needs to be considered when implementing renewable infrastructure. Because many of the rural regions served by cooperatives rely on coal plants for jobs and tax revenue, the prospect of closing them remains politically and economically challenging. Coal mining and power plant workers are by no means unskilled laborers, but the skills mismatch that comes with transitioning to renewable sources of energy may mean job loss for workers if training, grants, and assistance are not provided.

If the goals outlined in the Next Generation Act are to be achieved on time or at all, all utility providers will need to be able to participate in the infrastructure overhaul, and that includes rural electric cooperatives. The tax credits and other supports created in the 1930s to get electric power to rural areas are still the tools co-ops use to keep generation and distribution affordable, but nearly 100 years later, they’re not sufficient to move this next great transition in energy delivery forward. As we work to modernize our energy horizon, it’s time to rethink policy around electric cooperatives, too.

For a printable version of this report, click here.